Comprehending Brand Popularity

BrandTrends demonstrates how to fully comprehend Brand Popularity in order to evaluate a brand’s strengths and flaws and promote increase in licensing appeal.

Some brands may be well-known, but they fail to pique consumer attention. Others are appealing, but only to a specific audience. Then, how can you find the most enticing licenses, the ones with the most promise, and create an appropriate marketing strategy to help you grow? This is what BrandTrends discusses in the next section.

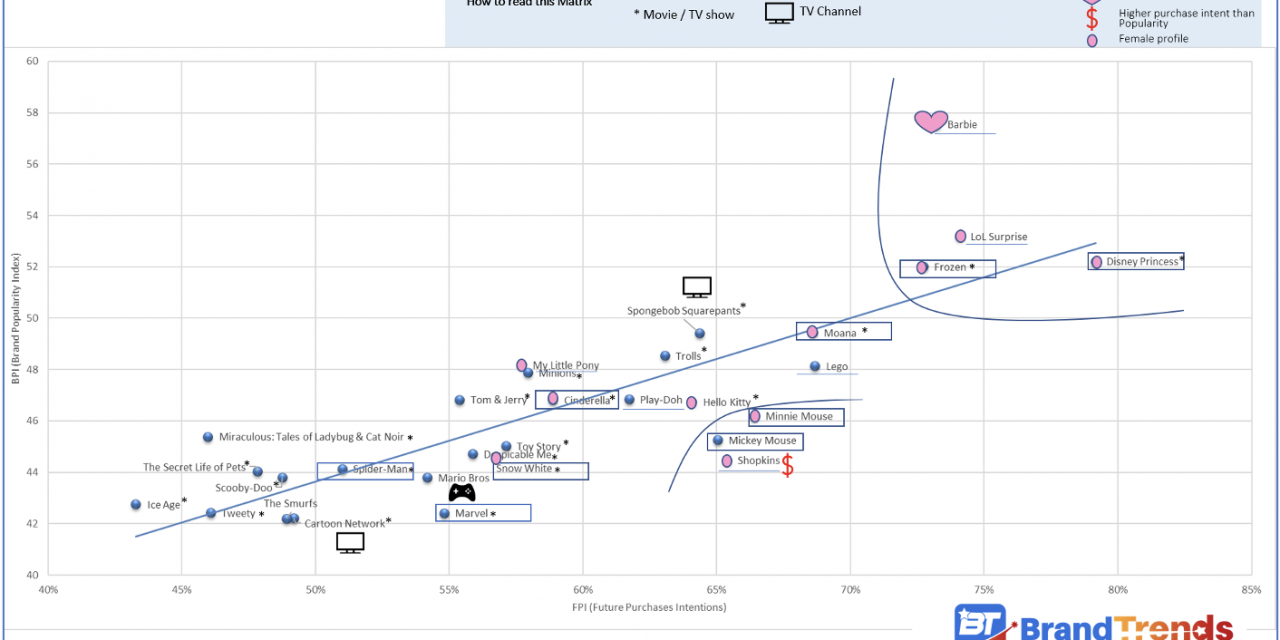

The brand matrix is one of the key BrandTrends analyses. For the Top 30 most popular brands, it relates the Brand Popularity Index with Purchase Intent.

The Brand Popularity Index is BrandTrends’ one-of-a-kind composite index. It is a composite of the brands’ salience (unaided and aided awareness) and proximity (attitudes and top favorites). It was created with the goal of predicting Purchase Intent.

The ability of brands to inspire attraction for things offered in stores is known as buy intent.

The graph below shows how the Popularity Index and Purchase Intent work well together: the highest popularity (on top) is followed by the highest purchase intent (on the right). Barbie is the most popular brand, and Disney Princess has the highest buy intent.

This matrix is more than just a ranking of brands. It also aids in comprehending the dynamics of the American market for girls aged 7 to 9.

As a result, it emphasizes numerous critical insights about how the market is structured and what leads to target success.

First, the matrix reveals that the market is headed by four strong brands: Disney Princess, L.O.L. Surprise, Barbie, and Frozen, all of which have high popularity and buy intent. All of them successfully blend salience and beauty in the minds of consumers.

Second, the market is feminine, with 37% of brands having a female profile. This is especially true for high-end brands, implying that the higher the affinity, the higher the attractiveness. To remain relevant in this market, brands with a stronger trans-gender profile must provide an even better user experience, which Lego achieves successfully by multiplying licensing items and movies/tv series.

Third, the top brands have a large percentage of movies and TV series (60 percent vs. 53 percent on average), but toys and games have a low share compared to other countries (20 percent vs 24 percent). This emphasizes the importance of being visible on screen for girls aged 7 to 9 in the United States. The Kid attests to this.

Fourth, Disney / Marvel takes the lead among this target as a major video content provider. This is a mix of historic and heritage content (Disney Princesses, Minnie Mouse, Mickey Mouse, Cinderella, Snow White), as well as more modern and fashionable content (Disney Princesses, Minnie Mouse, Mickey Mouse, Cinder (Frozen, Moana, Marvel, Spider-Man). This provides the group with several options to engage with the target through varied contents and products.

Fifth, video games do not make the top 30 most popular brands. Only Mario Bros, surfing on Mario attractiveness and constant renewal of contents, is part of the game.

The Brand Matrix also aids in the understanding of how to develop successful brand strategies by highlighting critical areas for improvement.

Three brands encounter distinct but promising scenarios as part of the core learnings.

Barbie, the world’s most famous doll, is by far the most popular. Everyone is aware of it, and it is still highly valued. This proximity to customers, however, does not convert into merchandise attractiveness, and buy intent should be much higher. This demonstrates the absence of products on the market capable of meeting consumer expectations. By refining its licensing approach, the company should consider generating new sorts of content.

Miraculous: Tales of Ladybug and Cat Noir, however on a different level, encounters the same problem. The brand is more appealing than popular. This is due to a lack of products on the market, despite the fact that the brand has been growing for several years. By offering more products, the super-heroin would also create additional opportunities to connect with consumers and create a virtual circle for nurturing both salience and proximity, then settle its growth.

Minnie Mouse and Mickey Mouse, on the other hand, are in the opposite scenario. Their want to buy is greater than their popularity. They’re part of people’s lives as evergreen brands, so they don’t need to deliver material to be appealing. However, by implementing relevant licensing strategies, companies will be able to connect with their target audience more effectively, increase their appeal, and provide new prospects for growth.

It is critical for brands to understand what drives their popularity and to choose the appropriate indicator to focus on in order to increase their customer appeal. This can be determined by salience, proximity, offer, or a combination of these factors. Popularity can be tracked over time, between countries, and across goals to discover winning strategies and areas for development.